Mortgage Rates News, Photos, Videos and Tweets

Rising interest rates are pushing up the cost of owning a home. See how average mortgage repayments are increasing in every US state.

This interactive map shows by how much the average cost of owning a home has increased since January.

mortgage rates - Business Insider2:38am PDT - April 16th, 2022

Today's mortgage and refinance rates: April 15, 2022 | Average rate hits 5% for the first time since 2011

Average rates have finally hit the long-feared 5% benchmark. See how today's rates might impact your home purchase or refinance.

mortgage rates - Business Insider3:00am PDT - April 15th, 2022

Want to buy a house with your bitcoin? Here's how crypto-backed mortgages work

You can use cryptocurrency as collateral for a mortgage. Learn about how this works and whether it's a good option for you.

mortgage rates - Business Insider6:37am PDT - April 14th, 2022

Today's mortgage and refinance rates: April 14, 2022 | Rates back away from 5%

Mortgage rates have been increasing dramatically this year, but retreated slightly in recent days. See how today's rates might impact your mortgage.

mortgage rates - Business Insider3:00am PDT - April 14th, 2022

Knowing the difference between a mortgage banker and mortgage broker can help you get the most for your money

A Mortgage banker works for a single lending institution, while mortgage brokers are intermediaries who work with multiple lenders.

mortgage rates - Business Insider12:20pm PDT - April 13th, 2022

/cloudfront-us-east-1.images.arcpublishing.com/tgam/RCKHWBOC5NLI7J5ITXLSGTKJKY.jpg)

This rate hike will cool Canada's hot housing markets - The Globe and Mail

- This rate hike will cool Canada's hot housing markets The Globe and Mail

- Bank of Canada hikes benchmark interest rate to 1% CBC News

- CityBiz: Interest rate update, oil prices back above $100 a barrel CityNews Toronto

- W…

mortgage rates - The Globe And Mail

8:57am PDT - April 13th, 2022

Today's mortgage and refinance rates: April 13, 2022 | Rates are the highest they've been since 2018

Mortgage rates are increasing quickly, but they're still relatively low historically. See how today's rates might impact your mortgage.

mortgage rates - Business Insider3:00am PDT - April 13th, 2022

Mr. Cooper review: Mortgage lender with moving assistance and a guaranteed closing date

With its RightMove benefits, Mr. Cooper can help you have an easier homebuying experience. However, this lender ranks low in customer satisfaction.

mortgage rates - Business Insider11:01am PDT - April 12th, 2022

Posthaste: What a supersized rate hike by the Bank of Canada will mean to your mortgage - Financial Post

- Posthaste: What a supersized rate hike by the Bank of Canada will mean to your mortgage Financial Post

- It's time for the banks to reverse a rate grab from 2015 that punishes borrowers to this day The Globe and Mail

- Traders eye Bo…

mortgage rates - Financial Post

5:09am PDT - April 12th, 2022

Today's mortgage and refinance rates: April 12, 2022 | Rates still increasing

Mortgage rates are up again today and appear to be closing in on 5%. However, rates are still relatively low from a historic perspective.

mortgage rates - Business Insider3:00am PDT - April 12th, 2022

Today's mortgage and refinance rates: April 11, 2022

Mortgage rates have been increasing recently and have even hit 5% by some measures. Check out today's rates to see how they may impact your mortgage.

mortgage rates - Business Insider3:00am PDT - April 11th, 2022

Today's mortgage and refinance rates: April 10, 2022

Rates are up, but so are home values. Check out today's mortgage rates to see if a cash-out refinance makes sense for you.

mortgage rates - Business Insider3:00am PDT - April 10th, 2022

Today's mortgage and refinance rates: April 9, 2022

Mortgage rates have been increasing at a record pace and will likely continue to rise. See today's rates and how they might impact your mortgage.

mortgage rates - Business Insider3:00am PDT - April 9th, 2022

Today's mortgage and refinance rates: April 8, 2022 | Rates keep inching up

The average 30-year fixed mortgage rate hit 4.72% this week, according to Freddie Mac. Rates remain elevated today and will likely continue to rise.

mortgage rates - Business Insider3:00am PDT - April 8th, 2022

Today's mortgage and refinance rates: April 7, 2022 | Rates are up after brief pause

Though it seemed like mortgage rates might level out last week, they've resumed their upward climb and are elevated today.

mortgage rates - Business Insider3:00am PDT - April 7th, 2022

Explainer: The Fed's 'QT' plan: Then and now - Reuters.com

The Federal Reserve on Wednesday signaled it will likely start culling assets from its $9 trillion balance sheet at its meeting in early May and will do so at nearly twice the pace it did in its previous "quantitative tightening" exercise as it confronts infl…

mortgage rates - Reuters2:02pm PDT - April 6th, 2022

Today's mortgage and refinance rates: April 6, 2022 | Rates appear to stabilize

Mortgage rates have been increasing dramatically in recent weeks, but are less volatile this week. See how today's rates might impact your mortgage.

mortgage rates - Business Insider3:00am PDT - April 6th, 2022

Today's mortgage and refinance rates: April 5, 2022 | Rates remain at 3-year high

Average mortgage rates have reached their highest point in three years and are expected to continue to rise this year.

mortgage rates - Business Insider3:00am PDT - April 5th, 2022

Today's mortgage and refinance rates: April 4, 2022

Many experts didn't foresee rates rising as quickly as they have. Check out today's rates and how they could impact your monthly payment.

mortgage rates - Business Insider3:00am PDT - April 4th, 2022

Quicken Loans parent expects profit to surge ahead of U.S. IPO - Reuters

Rocket Companies Inc said on Friday it expects a profit of more than $3 billion in the second quarter compared to a loss a year earlier, as the parent company of the U.S. mortgage lender Quicken Loans gears up for an initial public offering (IPO).

mortgage rates - Reuters8:46am PDT - July 17th, 2020

U.S. homebuilding surges as coronavirus crisis sparks flight to suburbs, rural areas - Reuters

U.S. homebuilding increased by the most in nearly four years in June amid reports of rising demand for housing in suburbs and rural areas as companies allow employees flexibility to work from home because of the COVID-19 pandemic.

mortgage rates - Reuters6:30am PDT - July 17th, 2020

Bank of Canada governor's promise of low rates could spur housing speculators - Reuters UK

Bank of Canada Governor Tiff Macklem's reassurance that interest rates will remain low for at least two years could unleash a wave of speculative demand in the country's hottest housing markets, realtors and mortgage brokers warned.

mortgage rates - Reuters2:26pm PDT - July 16th, 2020

U.S. mortgage rates reach historic depths below 3%: Freddie Mac - Reuters India

U.S. 30-year fixed-rate mortgages fell below 3% for the first time in nearly 50 years, according to data released by Freddie Mac on Thursday.

mortgage rates - Reuters12:22pm PDT - July 16th, 2020

Bank of Canada governor's low rate promise could spur housing speculators - Reuters

Bank of Canada Governor Tiff Macklem's reassurance that interest rates will remain low for at least two years could unleash a wave of speculative demand in the country's hottest housing markets, realtors and mortgage brokers warned.

mortgage rates - Reuters11:20am PDT - July 16th, 2020

Bank of Canada governor's low rate promise could spur housing speculators - Reuters

Bank of Canada Governor Tiff Macklem's reassurance that interest rates will remain low for at least two years could unleash a wave of speculative demand in the country's hottest housing markets, realtors and mortgage brokers warned.

mortgage rates - Reuters11:02am PDT - July 16th, 2020

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:39pm PDT - July 25th, 2023

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:38pm PDT - July 25th, 2023

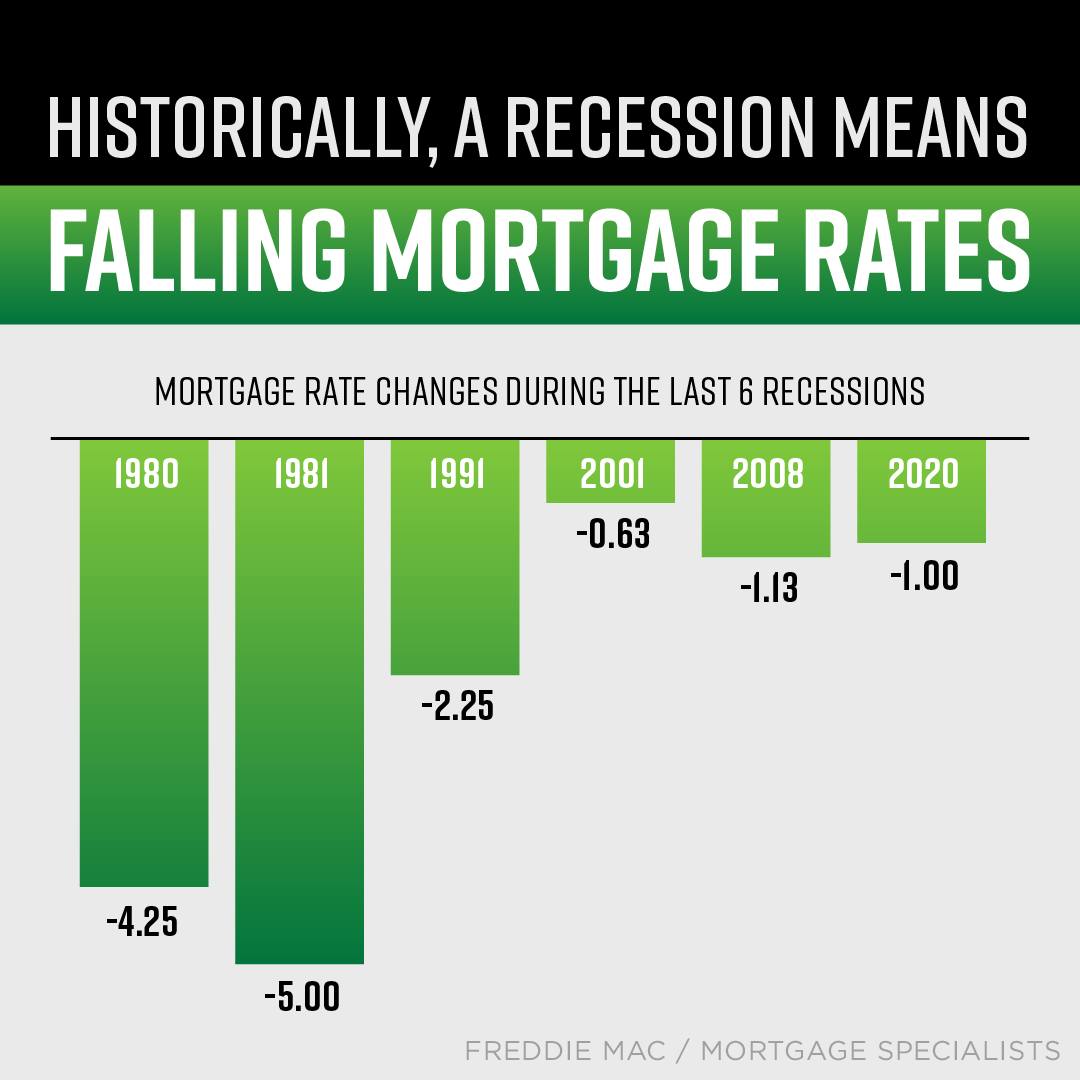

Historically, whenever the economy has slowed down, mortgage rates have fallen. While the past can’t predict the future, we can certainly learn from it. If you’re thinking about making a move this year, let’s talk about your goals. #realestate #Philly https://t.co/kShzgBpY0k

8:37pm PDT - July 25th, 2023

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:34pm PDT - July 25th, 2023

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:32pm PDT - July 25th, 2023

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:32pm PDT - July 25th, 2023

RT @PierrePoilievre: This article proves that if Trudeau would rein in his reckless spending, the Bank of Canada would not have to hike rat…

8:31pm PDT - July 25th, 2023

RT @NewsLambert: Whenever I talk about the so-called "lock-in effect", I'm talking about the hit to "new listings" —not "active listings".…

9:56am PDT - July 23rd, 2023

RT @RobertCottoJr: "90% of homeowners with a mortgage have a rate that's less than 4%, according to an analysis by Redfin. Now that rates h…

9:56am PDT - July 23rd, 2023

RT @RobertCottoJr: So people that have houses now may not want to or can't sell because the interest rates on their loans are lower than cu…

9:56am PDT - July 23rd, 2023

Is the main way Fed hurts consumers w high rates through mortgage rates? Don’t think higher credit card rates matter (savings higher). They kept ZIRP for too long that everyone refinance their homes. Maybe no recession coming soon…but when it comes it will be gargantuan https://t.co/nvvzOMpLD7

9:54am PDT - July 23rd, 2023

RT @NewsLambert: Whenever I talk about the so-called "lock-in effect", I'm talking about the hit to "new listings" —not "active listings".…

9:53am PDT - July 23rd, 2023

RT @HousingWire: It hasn’t been this hard to buy an existing home in at least a decade https://t.co/qi3fEdUJcT

9:46am PDT - July 23rd, 2023

So people that have houses now may not want to or can't sell because the interest rates on their loans are lower than current mortgage rates? But what about building lobby claims about lack of housing supply from not enough construction or zoning rules? I detect a hustle. https://t.co/vFSyGz8UBS

9:44am PDT - July 23rd, 2023

Mortgage rates dropped this week, but lack of homes for sale prevailed as the top concern among buyers. #tradingopportunity #stocks #Financialinvestment @headingcast

9:42am PDT - July 23rd, 2023

RT @robinparkin: It’s not working Bank of England is it? bring the bloody interest rates back down to 2% now!!! Before it bankrupts many ha…

9:40am PDT - July 23rd, 2023

RT @NewsLambert: Whenever I talk about the so-called "lock-in effect", I'm talking about the hit to "new listings" —not "active listings".…

9:38am PDT - July 23rd, 2023

The mortgage industry has been on a roller coaster ride the last couple years. Being able to afford a new home with a traditional fixed-rate mortgage has been difficult with high interest rates. Read the alternative financing options buyers are relying on: https://t.co/kp8kOwgnyG https://t.co/IfIorkSr2c

5:21pm PDT - July 22nd, 2023

RT @NBCNightlyNews: With high home prices and mortgage rates, there's a growing trend of parents buying properties for their children, allo…

5:17pm PDT - July 22nd, 2023

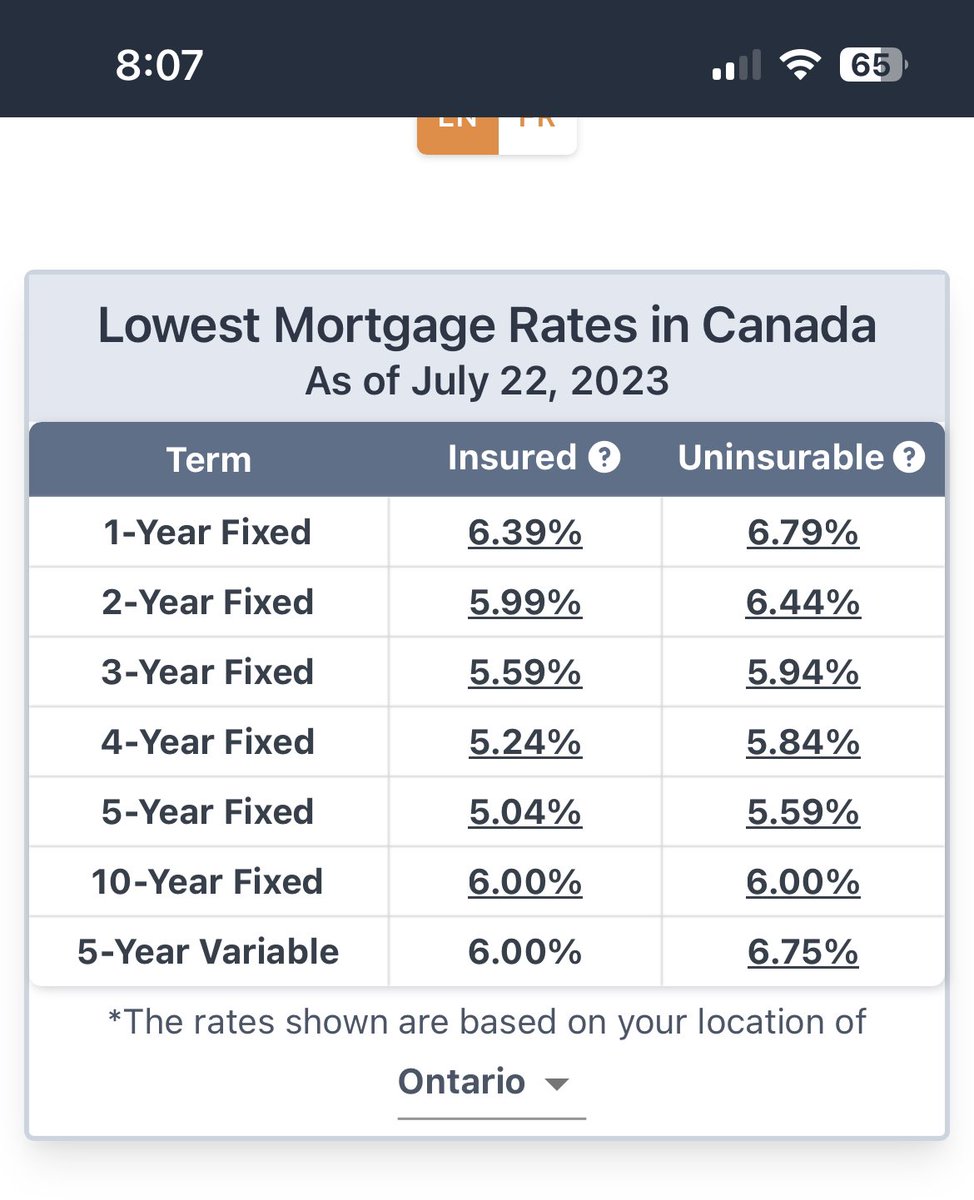

Mortgage Rates as of today #mortgagerates https://t.co/B4fYshPSXA

5:09pm PDT - July 22nd, 2023

RT @coinbase: 1/ Mortgage rates in Mozambique have reached as high as 22%. Much of the population along the coastline can’t get a loan to b…

5:05pm PDT - July 22nd, 2023

RT @UrbanLandRent: It’s amazing people still cling to the bubble story year 2 into high interest rates. Mortgage rates are 7%, inventory is…

4:59pm PDT - July 22nd, 2023

RT @NormanLevine100: Between retail sales slowing, people not using their boats or joining golf clubs, higher mortgage rates in Canada are…

4:58pm PDT - July 22nd, 2023

Between retail sales slowing, people not using their boats or joining golf clubs, higher mortgage rates in Canada are taking a toll and will affect Canada’s economy much more than in the U.S. as mortgages renew every 4 years in Canada vs 30 years in U.S. https://t.co/e1MLquFVp0

4:57pm PDT - July 22nd, 2023

Mortgage rates fall for first time in two months https://t.co/vcY8UmXgrX https://t.co/4wRumvf1If

4:50pm PDT - July 22nd, 2023

Mortgage rates: Six reasons why the pain isn't as bad as it could be https://t.co/EZx1YHbCwJ https://t.co/RqEWTPcgSQ

4:50pm PDT - July 22nd, 2023

Lenders are under fire for not extending a series of rate rises to savings accounts while ramping up mortgage and other borrowing costs. https://t.co/zd72AwtorS

4:46pm PDT - July 22nd, 2023

RT @MelissaMbarki: Does anyone review his policy ideas before he says them out loud? “forcing banks to give lower interest rates to famil…

4:39pm PDT - July 22nd, 2023

RT @sashayanshin: After mortgage rates go up, the average UK family is f****d. Median UK Household Disposable Income: £32,300. This is £2,…

4:37pm PDT - July 22nd, 2023

Mortgage Rates Today, July 22, & Rate Forecast For Next Week https://t.co/vTHL7n24cl

4:33pm PDT - July 22nd, 2023

Tell the government their scheme to hike interest rates only helps the big banks & the only people to blame for inflation is the greedy corporation & price gouging. Reduce Mortgage Interest Rates & Prevent Further Hikes - Sign the Petition! https://t.co/cTobOxoXht via @CdnChange

4:32pm PDT - July 22nd, 2023

Don’t Wait for Mortgage Rates to Drop: Here’s What Homebuyers Should Do Instead #NewsBreak https://t.co/WXKgi5fVBu

4:25pm PDT - July 22nd, 2023

RT @sashayanshin: After mortgage rates go up, the average UK family is f****d. Median UK Household Disposable Income: £32,300. This is £2,…

4:25pm PDT - July 22nd, 2023

Middle class homebuyers taking $7k mortgages planning to later refinance down https://t.co/9knrZUKgaX

7:49pm PDT - July 21st, 2023

RT @ronmortgageguy: If anyone doesn't believe the combination of Batshit Crazy House Prices, unprecedented levels of Immigration and a 400%…

7:45pm PDT - July 21st, 2023

RT @MoreBirths: Build more homes, @bryan_caplan urges, to boost the low fertility rates in urban areas. Folks should be able to get a mortg…

7:43pm PDT - July 21st, 2023

RT @CarrollJackie99: @13sarahmurphy Every time they talk they end with the same phrase… “Deliver for the people” Well, over 13 years they…

7:42pm PDT - July 21st, 2023

RT @maxentropy4344: Dejardins: In short, there will be pressure on the Bank of Canada to push rates to low levels in 2025 to prevent a subs…

7:42pm PDT - July 21st, 2023

RT @MelissaMbarki: Does anyone review his policy ideas before he says them out loud? “forcing banks to give lower interest rates to famil…

7:39pm PDT - July 21st, 2023

RT @wwmtnews: The median price for an already existing home stood at about $410,000 last month, according to data from the National Associa…

7:38pm PDT - July 21st, 2023